Anime’s Great Decoupling Paradox in the West

How Japanese producers are attempting to change the consensus business model of anime

The global anime market is experiencing unprecedented growth, roaring past $30B in 2024, yet Japanese producers are increasingly confronting a fundamental paradox in how they monetize their intellectual property (IP) in Western markets. Instead of relying on traditional sourcing and distribution channels, more organizations are starting to strategically invest to maximize revenue outcomes, both directly and indirectly. Their typical revenue inputs are deceptively simple: streaming royalties and consumer products. Yet, the execution of these strategies has led to what I call Anime’s Great Decoupling Paradox in the West.

The paradox manifests in three areas where producers (who often double as licensors) seek to maximize their revenues through a thesis of decoupling and gaining control, but simultaneously face contradictory challenges as they do so:

Source material outside the “Big 4” publishers

Marketing and consumer products outside Crunchyroll

Merchandise distribution independent of major retail

Understanding the paradox is crucial for any player looking to navigate the complexities of the situation and capitalize on the opportunities within the booming Western anime market.

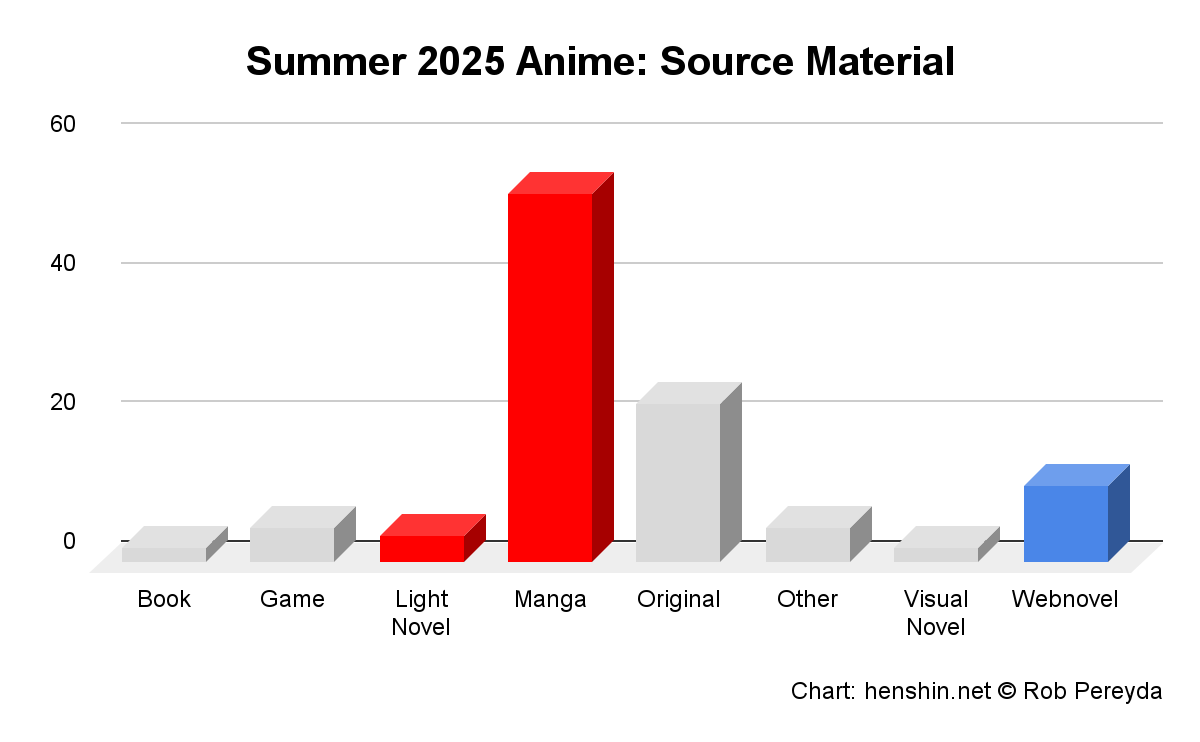

Source Material

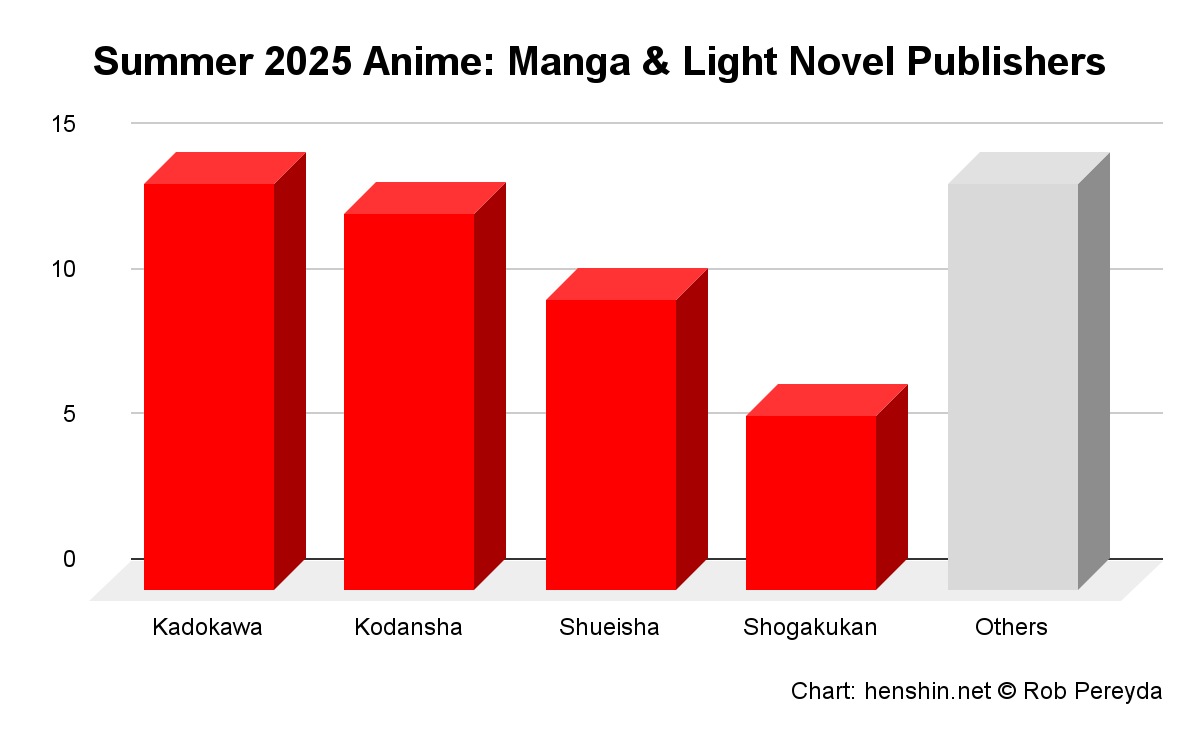

Take a look at the source material behind the Summer 2025 anime season, and roughly three-quarters of all adaptations from manga or light novels come from just four publishing giants: Shueisha, Shogakukan, Kodansha, and Kadokawa. These “Big 4” publishers dominate the adaptation pipeline thanks to their large scale, editorial rigor, and a proven domestic monetization engine. For investors, participating in one of the Big 4’s megahits is often a privilege reserved for “super producers” with longstanding relationships and capital, making it hard for small to mid-sized producers to get a piece of the pie of the kind of hits that travel globally.

Now, the IP landscape is starting to change. While megahits from the Big 4 remain some of the most coveted projects in the industry, recent breakouts like Umamusume (mobile game), Solo Leveling (Korean webnovel), and Lazarus (original anime) show the growing viability of alternate source material. And whereas small to mid-sized producers have been mostly shut out of the Big 4 megahits, they’re taking bets on these new sources of IP to build their business.

The Decoupling Challenge: While diversifying source material offers new opportunities, it can also disrupt a finely tuned ecosystem. Decoupling from the Big 4 risks losing the cadenced pre-launch visibility that multiple arcs of manga releases provide. With the exception of hit video games, source material outside manga and light novels risks being unseen. Furthermore, there is a large cohort of anime production talent who prefer to work on big-budget titles from top publishers, making it harder for non-Big 4 adaptations to attract top talent and gain visibility in the West.

Marketing & Consumer Products

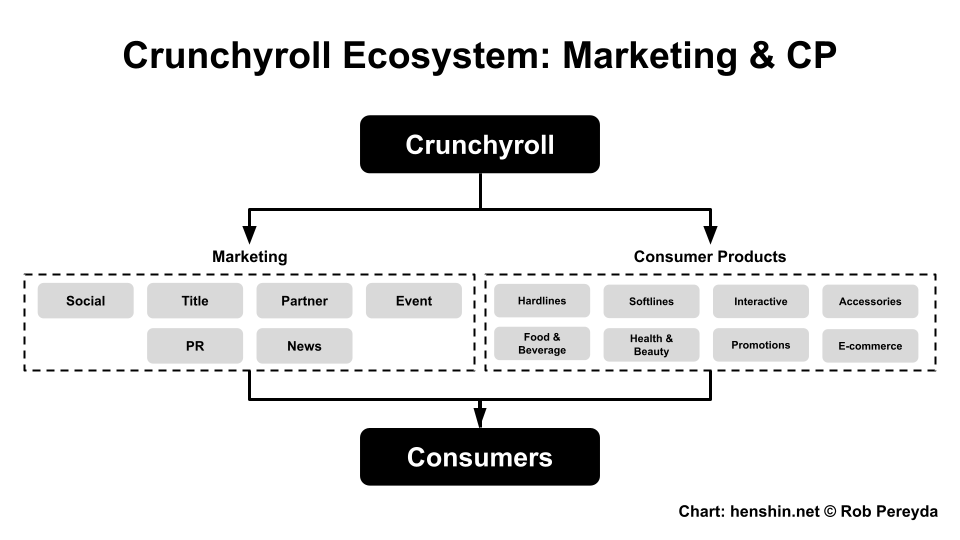

Crunchyroll stands as the undisputed leader in pureplay anime streaming outside Asia, and alongside Netflix, forms the “Big 2” of global anime distribution. Following its acquisition by Sony, “New Crunchyroll” consolidated legacy anime marketing infrastructure (Funimation) with streaming platform reach (“Old Crunchyroll”). The effect has been a behemoth that can monetize top anime from the earliest stages of simulcasts through to consumer products, developing a strong brand along the way.

For Japanese producers, Crunchyroll’s revenue generation ability has been powered by two core areas: streaming royalties (including advances and over royalties) and consumer products licensing. While other categories like theatrical and e-commerce can be meaningful in some cases, these two pillars remain the financial foundation. And with Crunchyroll now past the so-called “point of no return” in market dominance, few aim to disrupt it head on. Instead, licensors are shifting focus: not to replace Crunchyroll, but instead to extract more value from it.

The Decoupling Challenge: This shift increasingly involves producers running their own marketing and consumer products programs directly from Japan, sometimes while maintaining exclusive deals with Crunchyroll and sometimes not. The inherent trade off is that in gaining control of marketing and consumer products licensing, a producer-licensor may end up losing the pre-launch muscle Crunchyroll brings to the table if they go non-exclusive (note that in the world of streaming, non-exclusive titles are treated as retentive, not acquisitive by the big streamers, which affects marketing ROI calculations). Notable exceptions have been Demon Slayer from Aniplex of America and Dandadan from a consortium of Mainichi Broadcasting, GKIDS, and VIZ Media, so it’s not impossible to achieve. Most recently, REMOW is attempting to do this with Tougen Anki.

Retail

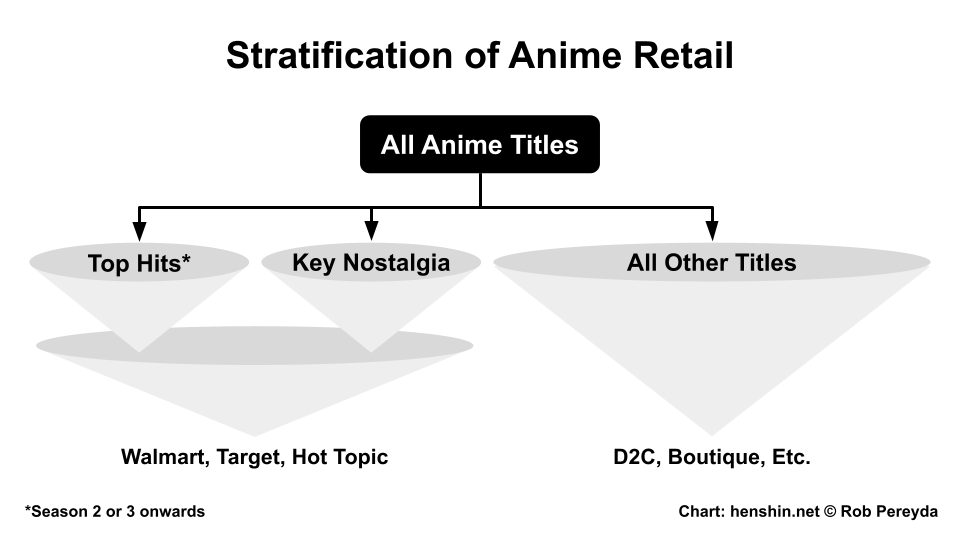

In the anime industry, Japanese producers have long coveted placement in three key U.S. retail chains: Walmart, Target, and Hot Topic. With over 7,000 locations between them, this “holy trinity” represents the perceived gold standard of anime consumer products success. Barnes & Noble maintains strong anime relevance thanks to manga sales, but these three remain the primary target in the eyes of most licensors.

However, the unforgiving math of merchandising presents a significant barrier to actually getting placed. Shelf space is limited, physical inventory carries substantial costs (and accrued interest), and buyers tend to favor “safer bets” such as evergreens and cult classics to reduce the chances of returns or liquidations. As a result of getting burned by rushing to “the next big thing” in the past, stores now lean heavily on evergreen hits and cult classics with proven performance. Even breakout titles like Solo Leveling only gained meaningful traction with season two due to the supply chain prioritizing predictability over raw demand.

The Decoupling Challenge: Licensors now face a dual challenge: securing trinity placement for their “top” titles (where “top” is often defined by internal hierarchy, not line manager expertise), and developing go-to-market strategies for niche or emerging IP that may never break into mass retail but still command deeply engaged fandoms. For the latter, the market has already played out in the anime gaming sector where “gacha” mechanics don’t require IP to have a volume of fans, just a depth of fandom. Anime producers are ultimately trying to bring merchandise closer to fans, even if it means they have to write entirely new playbooks. But attempting to decouple across retail is not only harder, it’s contradictory, as producers yearn for placement in the holy trinity of anime retail, despite it being unviable for many titles. Understanding the stratification of retail and developing alternative sales channels (D2C, boutique, pop-up, etc.), poses a significant challenge to producers trying to decouple.

The Enduring Paradox and What’s Next

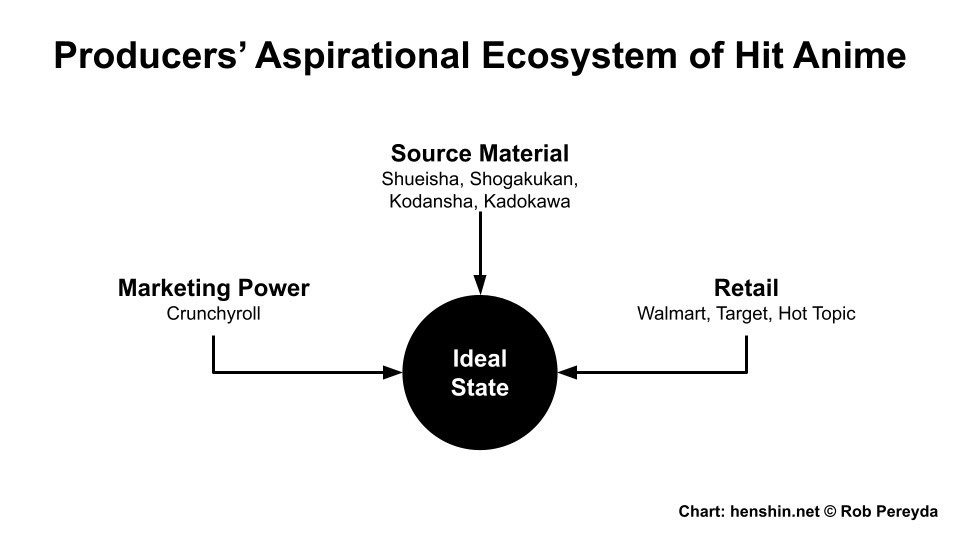

At the heart of Anime’s Great Decoupling Paradox is an ideal: licensor-producers envision a megahit anime adapted from a Big 4 title, simulcast on Crunchyroll to millions, generating over royalties, and driving a multi-season consumer products program with prime placement at Walmart, Target, and Hot Topic. This remains the clearest path to scale and revenue.

But gaining control over any single part of this interconnected chain often weakens another. Big 4 manga source material benefits from a manga-to-anime pipeline that builds anticipation. Exclusive distribution on Crunchyroll unlocks global marketing muscle. Aligning with the cycles of the holy trinity of anime retail reduces risk from returns and liquidations.

To move forward, licensor-producers — and the broader anime ecosystem — must take a strategic view. Consider:

Source Material is Evolving: The Big 4 will remain dominant, but alternative sources like games and webtoons are gaining traction. The challenge lies in activating these fanbases early enough to replicate the built-in hype serialized manga generates leading up to their streaming debuts.

Crunchyroll Will Continue to Dominate: Crunchyroll will remain the leading pure-play anime streamer. While some producers will attempt to decouple marketing and consumer products, this approach demands extreme sophistication, and for most, it won’t be the right model.

Retail is Stratified: Walmart, Target, and Hot Topic will remain the top tier of anime retail. Identifying which titles go through these channels, and which are better suited for direct-to-consumer or boutique strategies, is critical. Lessons from anime games and their high-spend user monetization may offer new opportunities in niche retail.

Anime’s Great Decoupling Paradox in the West is unfolding in real time. As ever-larger amounts of capital flow into the space, the tension will only grow. Success will hinge on each player’s ability to understand and navigate the ecosystem’s interconnected dynamics: knowing when to couple, when to decouple, and how to execute with finesse.

After all, anime thrives on the fantastic. Today’s paradox could become tomorrow’s portal. And just like in a show, it may take something somewhat catastrophic and extreme (in anime terms, “getting isekai’d”) to transport us to the next world where a new anime ecosystem awaits.

Great post! Umamusume's case is a bit strange though, and could almost be treated as an anime original in terms of how it got popular. While the original material was for a game, Cygames didn't plan very well and ended up releasing the game 3 years after the anime's debut (and decent reception)

In terms of retail... do you think this holds with the increasing price point and acceptance of collectibles? It is not crowding out (together with games) other types of licensed merchandise?